Hi there! If you’re starting your home-buying journey, you’ve probably heard the terms pre-qualification and pre-approval thrown around. While they might sound similar, they serve different purposes—and knowing the difference can save you time and set you up for success!

Pre-Qualification: The Quick Snapshot

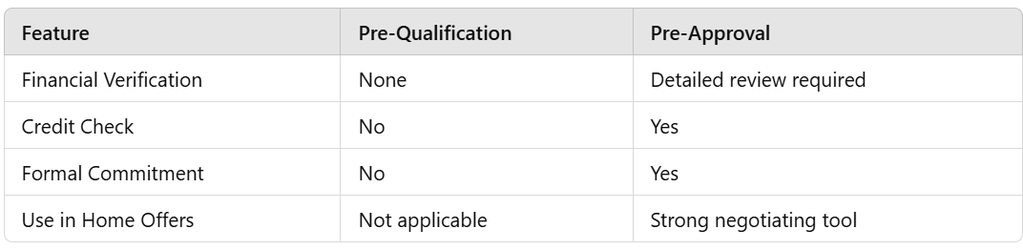

Think of pre-qualification as your first step. It’s like a casual conversation with a lender where they estimate how much home you can afford based on the information you provide.

- What You Provide: Basic financial details like your income, debts, and assets.

- How It Works: This is typically done online or over the phone and doesn’t involve a credit check.

- What You Get: An estimate of your loan amount, but not a guaranteed approval.

💡 Tip: Pre-qualification is a great way to get a ballpark idea of your budget, but it’s not enough to make serious offers on homes.

Pre-Approval: The Serious Step

Pre-approval takes things up a notch. It’s a formal process where the lender verifies your financial information and performs a credit check to determine how much they’re willing to lend you.

- What You Provide: Detailed documents like pay stubs, tax returns, and bank statements.

- How It Works: The lender reviews your finances and issues a pre-approval letter.

- What You Get: A solid commitment from the lender that you’re approved for a specific loan amount, pending property appraisal and final approval.

💡 Tip: Sellers take pre-approved buyers more seriously, so this is a must-do before you start house hunting!

Key Differences: Pre-Qualification vs. Pre-Approval

Which One Should You Choose?

If you’re just exploring your options, start with pre-qualification. But once you’re ready to shop for a home, pre-approval is the way to go! It positions you as a serious buyer and gives you an edge in competitive markets.

Let’s Talk!

Still have questions about pre-qualification or pre-approval? Feel free to reach out—we’d love to guide you through the process and help you find your dream home.