Buying a home is one of the biggest financial steps you’ll take, and your credit score plays a HUGE role in making it happen! But how good does your credit need to be? 🤔

Why Your Credit Score Matters

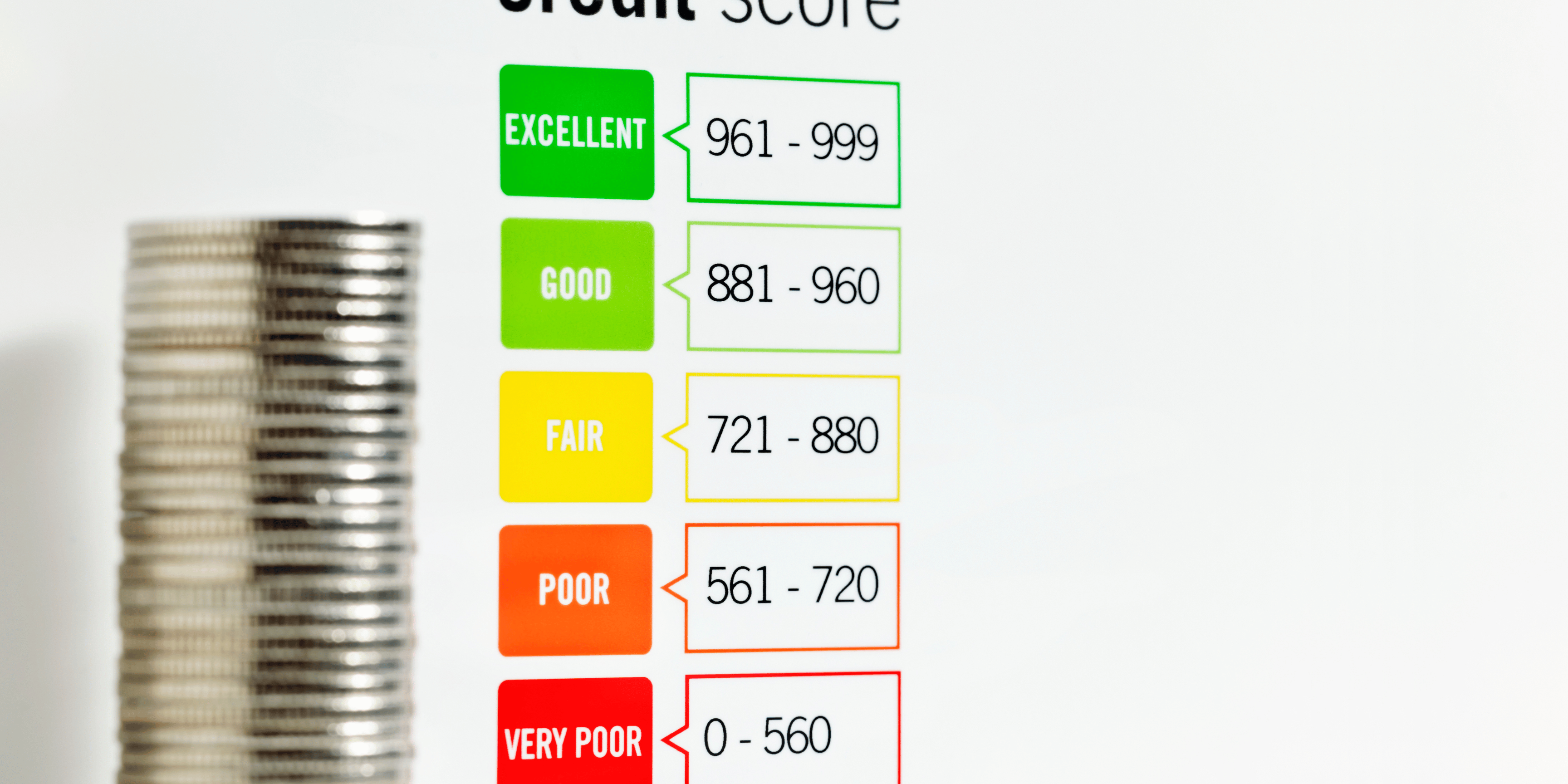

Lenders look at your credit score to determine if you’re a low-risk or high-risk borrower. A higher score usually means better loan terms, lower interest rates, and a smoother homebuying experience.

What’s the Minimum Credit Score to Buy a House?

Here’s a quick breakdown of what different loan types require:

✔️ Conventional Loans – 620+ (Higher scores get better interest rates.)

✔️ FHA Loans – 580+ (You can qualify with a lower down payment.)

✔️ VA Loans – 580-620 (For eligible veterans and active military.)

✔️ USDA Loans – 640+ (For rural homebuyers, often with zero down payment.)

What If Your Credit Score Isn’t Perfect?

Don’t worry! If your score isn’t quite there yet, here are a few quick fixes:

✅ Pay down credit card balances.

✅ Avoid opening new credit accounts before applying for a mortgage.

✅ Make all payments on time (even small bills!).

✅ Check for errors on your credit report and dispute any mistakes.

💡 Pro Tip: Some lenders allow lower scores with larger down payments!

Final Thoughts: Can You Still Buy a Home?

YES! Your credit score is important, but it’s not the only factor. Lenders also look at your income, debt-to-income ratio, and savings. So even if your score isn’t perfect, homeownership is still possible!

📢 Got questions about buying a home with your current credit score? Drop them in the comments or send me a message!